Press releases

-

Press

PressNew study on the impact of women's networks in companies 17.12.2025 -

Press

PressEBS Europa Institut presents position paper on bureaucracy costs in Brussels 03.12.2025 -

Press

PressEBS Universität achieves triple success in the Universum Talent Research Ranking 2025 11.11.2025 -

Press

PressEBS and NYU Launch Research Center 01.10.2025 -

Press

PressGraduation Ceremony 2025 01.09.2025 -

Press

PressNew EBS Study: The Influencer Dilemma 24.06.2025 -

Press

PressSparkasse Oberhessen intensifies cooperation with the Europainstitut at EBS Universität 20.05.2025 -

Press

PressHamburg becomes the new home of EBS Master in Real Estate programme 05.05.2025 -

Press

PressEBS Universität again featured in CEO Magazine’s Global MBA Ranking 2025 24.03.2025 -

Press

PressStudy Reveals Key Trends for the Project Management's Future 26.02.2025 -

Press

PressOnline Master programme for lawyers: EBS Universität offers part-time programme with a... 12.12.2024 -

Press

PressThe Effectiveness of Diversity in Companies – Between Myths and Potentials 07.11.2024 -

Press

PressCEO Magazine 2024 Global MBA/EMBA Rankings: EBS ranks Tier One 27.03.2024 -

Press

PressEBS among the top 5 universities for Germany's best auditors 26.03.2024 -

Press

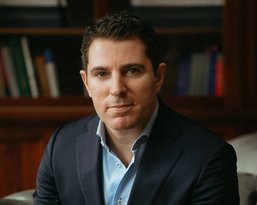

PressChristof Hettich elected Chairman of the University Council of EBS Universität 07.03.2024 -

Press

PressChange of personnel at EBS University 06.02.2024 -

Press

PressEBS Universität and GILT launch education initiative 24.01.2024 -

Press

PressEBS Universität opens European Institute 30.11.2023 -

Press

PressVolker Bouffier elected to the University Council of EBS Universität 29.11.2023 -

Press

PressNikolas Müller new Head of EBS Real Estate Management Institute 13.11.2023 -

Press

PressEBS Universität ranks among the Top 10 German Universities for Business Administration in the... 16.05.2023 -

Press

PressCHE Ranking: EBS Universität ranks in top positions 09.05.2023 -

![[Translate to English:] News_Wasserfilter Projekt Two groups of people are presenting a blue water filter called "PAUL." On the left, two men are in a vineyard; one is holding a tablet while the other holds a hose. On the right, there is a group of five people surrounding the water filter.](/fileadmin/_processed_/b/4/csm_News_Wasserfilter_Projekt_90fd1343e6.jpg) Press

PressStudents from Germany and Uganda support refugees with water filters 17.03.2023 -

Press

PressEBS students support HelpingHands Eltville with over 14,500 euros 07.03.2023 -

![[Translate to English:] AACSB Accredited logo featuring a geometric design with green and teal colors alongside the text "AACSB ACCREDITED."](/fileadmin/_processed_/0/2/csm_Logo_AACSB_6db7f0036a.jpg) Press

PressEBS Universität awarded AACSB accreditation 21.02.2023 -

Press

PressNew bachelor programme "Law, Politics & Economics" at EBS University starts in 2023 08.12.2022 -

Press

PressEBS University receives the Deutsche Bildungs-Award 2022 17.11.2022 -

Press

PressStudying Law smart 11.11.2022 -

Press

PressEBS University includes "Legal Engineering" in the curriculum 20.10.2022 -

Press

PressEBS University's new Brand Presence 18.10.2022 -

Press

PressWhitepaper „Seizing the Potentials of Business Ecosystems“ 14.07.2022 -

Press

PressHeinz Maier-Leibnitz Prize for Dr. Dr. Hanjo Hamann from EBS Universität 03.05.2022 -

Press

PressNewly founded BRYTER Center for Digitalization and Law at EBS Universität is addressing... 02.03.2022 -

Press

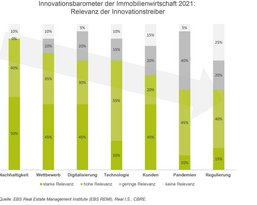

PressStudy: ESG requirements are biggest driver of innovation 03.02.2022 -

Press

PressEBS Universität starts second construction phase: Campus Schloss gets a new Mensa 25.01.2022 -

Press

PressFirst 100 days in office: EBS University Management takes an initial stock 20.12.2021 -

Press

PressHow the COVID 19 pandemic influences societal values 19.10.2021 -

Press

PressInauguration ceremony for Günther H. Oettinger as President and Professor Martin Böhm as... 13.09.2021 -

Press

PressEBS Universität Sets Further Course for Success 20.05.2021 -

Press

PressHow does management consulting work during lockdown? 12.05.2021 -

Press

PressSurvey by EBS Universität and the Social Entrepreneurship Netzwerk Deutschlands (SEND): What... 10.02.2021 -

Press

PressEBS Universität celebrates 50th anniversary 13.01.2021 -

Press

PressHesse’s best law graduate is EBS Student 09.12.2020 -

Press

PressEBS University is to become part of SRH Higher Education 28.07.2016

News

-

News

NewsThe ‘party paradox’: EBS expertise for the NYU Law Democracy Project 18.12.2025 -

News

NewsEBS expertise shapes European policy 15.12.2025 -

News

NewsEBS once again among Germany's best business schools in the Financial Times... 01.12.2025 -

News

NewsLegal Innovation Talk on ‘AI in Higher Education’ 24.11.2025 -

News

NewsTobias Gutmann honoured as one of the ‘Top 40 under 40’ 14.11.2025 -

News

NewsShaping the future together: EBS cooperates with Anna Schmidt Schule 01.10.2025 -

News

NewsSRH Social Impact Thesis Awards 2025 04.09.2025 -

News

News“Hochschulperle” of the Month for the Siemens Product Innovation Lab 05.08.2025 -

News

NewsEBS student attends LSGL Summer School in South Africa 17.07.2025 -

News

NewsEBS ranked again among Top Business Schools in Financial Times Ranking 16.06.2025 -

News

NewsProfessor Dr Sarah Legner awarded the 2024 Helmut Schippel Prize 11.06.2025 -

News

NewsEBS-Alumna Felicia von Reden among Forbes 30 Under 30 Europe 2025 05.06.2025 -

News

NewsEBS Alumnus Tobias Hoss named to Forbes 30 Under 30 Europe 2025 02.06.2025 -

News

NewsInternational doctoral seminar on non-profit law 28.05.2025 -

News

NewsEBS doctoral student Luisa Zöllner receives scholarship from the Friedrich Naumann... 23.04.2025 -

![[Translate to English:] News_Hamann_IT_Rechtspreis](/fileadmin/_processed_/f/1/csm_IT-Rechtspreis_c26746d2d5.jpg) News

NewsSecond place at the German IT Law Prize 2025: Hanjo Hamann honoured by the German Bar... 15.04.2025 -

News

NewsWegagen Bank S.C. visits EBS for Executive Education Programme 02.04.2025 -

News

NewsFuture-orientated teaching: EBS drives innovation forward 17.03.2025 -

News

NewsEBS students selected for the WiWi Talents programme 24.02.2025 -

News

NewsProcter & Gamble joins the EBS Sustainability Partner Group 29.01.2025 -

News

NewsEBS Universität significantly improves in FT European Business School Ranking 2024 02.12.2024 -

News

NewsEBS Universität receives the German Education Award 2024/2025 18.11.2024 -

News

NewsEBS Real Estate Programme successfully re-accredited by RICS 24.10.2024 -

News

NewsFrom EBS network to successful scale-up: EBS alumnus Matteo Benedetti 11.10.2024 -

News

NewsEBS Professor Dr. Franziska Krause wins the Jürgen Hauschildt Award 2024 10.09.2024 -

News

NewsEBS Universität achieves excellent position in the Financial Times Ranking 09.09.2024 -

News

NewsMourning for Professor Dr Klaus Evard: Founder of EBS Universität has passed away 03.09.2024 -

News

NewsAwarding of the SRH Social Impact Thesis Awards 2024 03.09.2024 -

News

NewsResearch assistant Carina Keller wins William H. Newman Award at Academy of Management 14.08.2024 -

News

NewsEBS Law School student Mara attends the LSGL Summer School in Bogotá 07.08.2024 -

News

NewsEBS Universität honoured in the Universum Talent Research Ranking 2024 25.07.2024 -

News

NewsEBS student Maja Schneider selected for the WiWi-Talent High Potential Programme 15.07.2024 -

News

NewsNew team of deans elected at EBS Business School 08.07.2024 -

News

NewsService Learning Centre: EBS students support communities and local authorities 25.06.2024 -

News

NewsEBS students honoured by Hessian Minister of Justice 21.06.2024 -

News

NewsWirtschaftsWoche Ranking 2024: EBS again among the top 10 18.06.2024 -

News

NewsFinancial Times Ranking: EBS Universität achieves again excellent rankings 17.06.2024 -

News

NewsHessian Minister of the Interior Roman Poseck gives keynote speech at EBS Law School 27.05.2024 -

News

NewsCooperation agreement between R+V Versicherung and EBS Universität 21.05.2024 -

News

NewsEBS Universität announces new partnership with Ryon 08.05.2024 -

News

NewsWorking with the world leader Tetra Pak for a sustainable future 03.05.2024 -

News

NewsEBS Diversity & Refugee Law Clinic: Working together for justice and diversity 26.04.2024 -

News

NewsGenerative AI in copyright law: EBS Professor Hanjo Hamann speaks at conference 04.03.2024 -

News

NewsNew Dean of the Law School at EBS Universität 29.02.2024 -

News

NewsA Journey to €1 Billion in Assets Under Management at Source For Alpha 19.02.2024 -

News

NewsRe-accreditation of Master's programmes until 2031: focus on quality and... 13.02.2024 -

News

NewsCHE Ranking of Master's programmes: EBS Business School achieves excellent results 20.11.2023 -

News

NewsFirst prize of the 18th EBS Best Paper Award goes to an international research team 16.11.2023 -

News

NewsEBS wins the German Education Award 2023/2024 02.11.2023 -

News

NewsEBS Universität among the world's top 50 in QS World University Ranking 2024 04.10.2023 -

News

NewsEBS at number 4 in the German Entrepreneurship Ranking 25.09.2023 -

News

NewsAwarding the SRH Social Impact Thesis Awards 2023 01.09.2023 -

News

NewsEBS Law School students attend the 11th LSGL Summer School in London 18.08.2023 -

News

NewsSuccessful professorial qualification for EBS Law School Prof. Sarah Legner 31.07.2023 -

News

NewsEBS Universität recognised for outstanding career opportunities by Universum Talent Research... 26.07.2023 -

News

NewsHighlights of the first EBS Coaching and Leadership Conference 20.07.2023 -

News

NewsEBS female students selected for the WiWi Talents programme 13.07.2023 -

News

NewsEBS among the top places in CEWS ranking in equality aspects 06.07.2023 -

News

NewsEBS Coaching & Leadership Conference: Peer coaching programs for working parents 30.06.2023 -

News

NewsEBS Coaching & Leadership Conference: Teamcoaching as a Gamechanger 20.06.2023 -

News

NewsNew Journal of Marketing study by EBS Professor Franziska Krause 15.06.2023 -

News

NewsStrategic importance of AI technologies for companies 12.06.2023 -

News

NewsFinancial Times Ranking: EBS Universität secures impressive positions 12.06.2023 -

News

NewsData-Driven Business Models: Joint Report by EBS Universität and PWC 02.06.2023 -

News

NewsService Learning Center at EBS: Empowering Students, Transforming Communities 30.05.2023 -

News

NewsIntegrating ESG factors in private equity investments drives higher returns 24.05.2023 -

News

NewsStrategies for supporting employees in the mourning transformation phase 19.05.2023 -

News

NewsPresident of the Federal Constitutional Court visits EBS Law School 17.05.2023 -

News

NewsStudy: One-of-a-Kind Products: Leveraging Strict Uniqueness in Mass Customization 26.04.2023 -

News

NewsEBS Law School Professor Hanjo Hamann elected as member of the Global Young Academy 14.04.2023 -

News

NewsThe impact of the digital transformation on the real estate sector 12.04.2023 -

News

NewsMaster's offensive at EBS Universität 04.04.2023 -

News

NewsProcess digitalisation as an opportunity for German mechanical engineering 30.03.2023 -

News

NewsThe influence of demographic change on the real estate industry 21.03.2023 -

News

NewsLeadership in the digital transformation 16.03.2023 -

News

NewsProf. Christian Landau re-elected Dean of EBS Business School 15.03.2023 -

News

NewsEBS Professor Karin Kreutzer among the Top 100 Women in Social Enterprise 2023 by Euclid... 09.03.2023 -

News

NewsProf. Segna as expert on new hr podcast 15.02.2023 -

News

NewsEBS students elected to the Wiwi Talents high potential program 06.02.2023 -

News

NewsScientific article in the IEEE Engineering Management Review 27.01.2023 -

News

NewsEBS & EY-Parthenon Research Project: ESG matters for Private Equity Returns 18.01.2023 -

News

NewsVolkswagenStiftung supports project at Law School 16.01.2023 -

News

NewsEBS alumna Dina Reit was chosen by Focus as one of the 100 Women of the Year 2022 12.01.2023 -

News

NewsJan-Christian Dreesen visits EBS Law School 25.11.2022 -

News

NewsEBS University and KPMG have developed an exclusive ESG Expert training 10.11.2022 -

News

NewsCenter for Responsible Digitalization (ZEVEDI) funds EBS research on "Tokenization and the... 10.11.2022 -

News

NewsEBS University reaches leading position in the recent WirtschaftsWoche ranking of the "best... 17.10.2022 -

News

NewsEBS student Christopher Jackson selected for WiWi-Talents high potential programme 13.09.2022 -

News

NewsIt all began with a smartphone case 03.08.2022 -

News

NewsEBS alumnus Philipp Harders raises 2.2 million euros 20.07.2022 -

News

NewsEBS Alumna Kim Fe Cramer started a professorship at London School of Economics 18.07.2022 -

News

NewsEBS Universität Opens BRYTER Center for Digitization and Law 07.07.2022 -

News

NewsThe Applicationprocess of EBS Universität 23.06.2022 -

News

NewsEBS alumnus Maximilian Rast raises 2.3 million euros with his start-up Klar 14.06.2022 -

News

NewsEBS Universität again in the Top 10 of the WiWo University Ranking 2022 22.04.2022 -

News

NewsEBS Universität among the top 10 best universities for auditors 12.04.2022 -

News

NewsNew professorship for digitisation law: Interview with Dr. Dr. Hanjo Hamann 11.04.2022 -

News

NewsProf. Tobias Gutmann wins Best Paper Award at the World Open Innovation Conference 2021 13.12.2021

Contact us

You can contact us at any time with enquiries about press releases, news and press materials.

Sabine Schnarkowski

Press and Public Relations Officer

You would like to stay up to date?

We will keep you up to date on the latest news from EBS Universität. Subscribe to the press list here.

Your requests

Do you have a general request for us?

Do not hesitate to send us a message via the general contact form.

Do you have questions about studying at EBS?

Please use our study counseling form.

Do you have questions about our executive education programmes?

Feel free to contact the EBS Executive School team via email or via phone.

Contact to our schools

EBS Business School

EBS Law School

EBS Executive School

Order your information material here

Order free information material about our study programmes and find out more about:

- Content of studies

- Admission requirements

- Tuition fees

- Funding opportunities