Press releases

-

Press

PressCEO Magazine 2024 Global MBA/EMBA Rankings: EBS ranks Tier One 27.03.2024 -

Press

PressEBS among the top 5 universities for Germany's best auditors 26.03.2024 -

Press

PressChristof Hettich elected Chairman of the University Council of EBS Universität 07.03.2024 -

Press

PressChange of personnel at EBS University 06.02.2024 -

Press

PressEBS Universität and GILT launch education initiative 24.01.2024 -

Press

PressEBS Universität opens European Institute 30.11.2023 -

Press

PressVolker Bouffier elected to the University Council of EBS Universität 29.11.2023 -

Press

PressNikolas Müller new Head of EBS Real Estate Management Institute 13.11.2023 -

Press

PressEBS Universität ranks among the Top 10 German Universities for Business Administration in the... 16.05.2023 -

Press

PressCHE Ranking: EBS Universität ranks in top positions 09.05.2023 -

Press

PressStudents from Germany and Uganda support refugees with water filters 17.03.2023 -

Press

PressEBS students support HelpingHands Eltville with over 14,500 euros 07.03.2023 -

Press

PressEBS Universität awarded AACSB accreditation 21.02.2023 -

Press

PressNew bachelor programme "Law, Politics & Economics" at EBS University starts in 2023 08.12.2022 -

Press

PressEBS University receives the Deutsche Bildungs-Award 2022 17.11.2022 -

Press

PressStudying Law smart 11.11.2022 -

Press

PressEBS University includes "Legal Engineering" in the curriculum 20.10.2022 -

Press

PressEBS University's new Brand Presence 18.10.2022 -

Press

PressWhitepaper „Seizing the Potentials of Business Ecosystems“ 14.07.2022 -

Press

PressHeinz Maier-Leibnitz Prize for Dr. Dr. Hanjo Hamann from EBS Universität 03.05.2022 -

Press

PressNewly founded BRYTER Center for Digitalization and Law at EBS Universität is addressing... 02.03.2022 -

Press

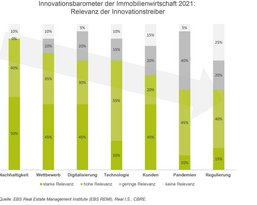

PressStudy: ESG requirements are biggest driver of innovation 03.02.2022 -

Press

PressEBS Universität starts second construction phase: Campus Schloss gets a new Mensa 25.01.2022 -

Press

PressFirst 100 days in office: EBS University Management takes an initial stock 20.12.2021 -

Press

PressHow the COVID 19 pandemic influences societal values 19.10.2021 -

Press

PressInauguration ceremony for Günther H. Oettinger as President and Professor Martin Böhm as... 13.09.2021 -

Press

PressEBS Universität Sets Further Course for Success 20.05.2021 -

Press

PressHow does management consulting work during lockdown? 12.05.2021 -

Press

PressSurvey by EBS Universität and the Social Entrepreneurship Netzwerk Deutschlands (SEND): What... 10.02.2021 -

Press

PressEBS Universität celebrates 50th anniversary 13.01.2021 -

Press

PressHesse’s best law graduate is EBS Student 09.12.2020 -

Press

PressEBS University is to become part of SRH Higher Education 28.07.2016

News

-

News

NewsGenerative AI in copyright law: EBS Professor Hanjo Hamann speaks at conference 04.03.2024 -

News

NewsNew Dean of the Law School at EBS Universität 29.02.2024 -

News

NewsA Journey to €1 Billion in Assets Under Management at Source For Alpha 19.02.2024 -

News

NewsRe-accreditation of Master's programmes until 2031: focus on quality and commitment ... 13.02.2024 -

News

NewsCHE Ranking of Master's programmes: EBS Business School achieves excellent results 20.11.2023 -

News

NewsFirst prize of the 18th EBS Best Paper Award goes to an international research team 16.11.2023 -

News

NewsEBS wins the German Education Award 2023/2024 02.11.2023 -

News

NewsEBS Universität among the world's top 50 in QS World University Ranking 2024 04.10.2023 -

News

NewsEBS at number 4 in the German Entrepreneurship Ranking 25.09.2023 -

News

NewsAwarding the SRH Social Impact Thesis Awards 2023 01.09.2023 -

News

NewsEBS Law School students attend the 11th LSGL Summer School in London 18.08.2023 -

News

NewsSuccessful professorial qualification for EBS Law School Prof. Sarah Legner 31.07.2023 -

News

NewsEBS Universität recognised for outstanding career opportunities by Universum Talent Research... 26.07.2023 -

News

NewsHighlights of the first EBS Coaching and Leadership Conference 20.07.2023 -

News

NewsEBS female students selected for the WiWi Talents programme 13.07.2023 -

News

NewsEBS among the top places in CEWS ranking in equality aspects 06.07.2023 -

News

NewsEBS Coaching & Leadership Conference: Peer coaching programs for working parents 30.06.2023 -

News

NewsEBS Coaching & Leadership Conference: Teamcoaching as a Gamechanger 20.06.2023 -

News

NewsNew Journal of Marketing study by EBS Professor Franziska Krause 15.06.2023 -

News

NewsStrategic importance of AI technologies for companies 12.06.2023 -

News

NewsFinancial Times Ranking: EBS Universität secures impressive positions 12.06.2023 -

News

NewsData-Driven Business Models: Joint Report by EBS Universität and PWC 02.06.2023 -

News

NewsService Learning Center at EBS: Empowering Students, Transforming Communities 30.05.2023 -

News

NewsIntegrating ESG factors in private equity investments drives higher returns 24.05.2023 -

News

NewsStrategies for supporting employees in the mourning transformation phase 19.05.2023 -

News

NewsPresident of the Federal Constitutional Court visits EBS Law School 17.05.2023 -

News

NewsStudy: One-of-a-Kind Products: Leveraging Strict Uniqueness in Mass Customization 26.04.2023 -

News

NewsEBS Law School Professor Hanjo Hamann elected as member of the Global Young Academy 14.04.2023 -

News

NewsThe impact of the digital transformation on the real estate sector 12.04.2023 -

News

NewsMaster's offensive at EBS Universität 04.04.2023 -

News

NewsProcess digitalisation as an opportunity for German mechanical engineering 30.03.2023 -

News

NewsThe influence of demographic change on the real estate industry 21.03.2023 -

News

NewsLeadership in the digital transformation 16.03.2023 -

News

NewsProf. Christian Landau re-elected Dean of EBS Business School 15.03.2023 -

News

NewsEBS Professor Karin Kreutzer among the Top 100 Women in Social Enterprise 2023 by Euclid... 09.03.2023 -

News

NewsProf. Segna as expert on new hr podcast 15.02.2023 -

News

NewsEBS students elected to the Wiwi Talents high potential program 06.02.2023 -

News

NewsScientific article in the IEEE Engineering Management Review 27.01.2023 -

News

NewsEBS & EY-Parthenon Research Project: ESG matters for Private Equity Returns 18.01.2023 -

News

NewsVolkswagenStiftung supports project at Law School 16.01.2023 -

News

NewsEBS alumna Dina Reit was chosen by Focus as one of the 100 Women of the Year 2022 12.01.2023 -

News

NewsJan-Christian Dreesen visits EBS Law School 25.11.2022 -

News

NewsEBS University and KPMG have developed an exclusive ESG Expert training 10.11.2022 -

News

NewsCenter for Responsible Digitalization (ZEVEDI) funds EBS research on "Tokenization and the... 10.11.2022 -

News

NewsEBS University reaches leading position in the recent WirtschaftsWoche ranking of the "best... 17.10.2022 -

News

NewsEBS student Christopher Jackson selected for WiWi-Talents high potential programme 13.09.2022 -

News

NewsIt all began with a smartphone case 03.08.2022 -

News

NewsEBS alumnus Philipp Harders raises 2.2 million euros 20.07.2022 -

News

NewsEBS Alumna Kim Fe Cramer started a professorship at London School of Economics 18.07.2022 -

News

NewsEBS Universität Opens BRYTER Center for Digitization and Law 07.07.2022 -

News

NewsThe Applicationprocess of EBS Universität 23.06.2022 -

News

NewsEBS alumnus Maximilian Rast raises 2.3 million euros with his start-up Klar 14.06.2022 -

News

NewsEBS Universität again in the Top 10 of the WiWo University Ranking 2022 22.04.2022 -

News

NewsEBS Universität among the top 10 best universities for auditors 12.04.2022 -

News

NewsNew professorship for digitisation law: Interview with Dr. Dr. Hanjo Hamann 11.04.2022

Contact us

You can contact us at any time with enquiries about press releases, news and press materials.

Anna Schneider

Head of press and public relations

You would like to stay up to date?

We will keep you up to date on the latest news from EBS Universität. Subscribe to the press list here.